When is Tax Day in 2023: A Detailed Overview

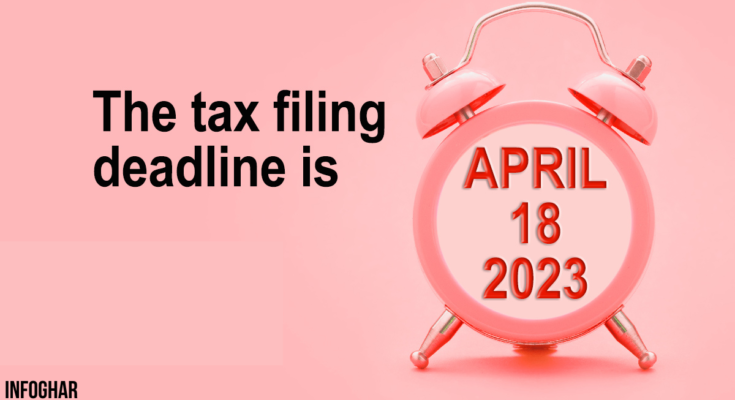

Today we will discuss When is tax day 2023 Few days are as important in the world of finance as Tax Day. Individual taxpayers have until today to submit their income tax forms to the government. The date of Tax Day in 2023 is April 17th. We will go through all the details of Tax Day 2023 in this post, giving you the knowledge you need to make sure your tax season goes smoothly.

Recognizing Tax Day

Describe Tax Day.

The deadline for individual taxpayers to file their income tax returns and make any necessary tax payments to the Internal Revenue Service (IRS) is known as Tax Day. It’s an important date for people and companies alike.

How come April 17th?

Tax Day is normally observed on April 15th; however, in the event that this day falls on a weekend or holiday, the deadline is extended to the following working day. Due to a Saturday falling on April 15, 2023, Tax Day is rescheduled to Monday, April 17.

Getting Ready for Tax Day and Gathering Paperwork

In order to properly file your taxes, you will require W-2s, 1099s, and deduction receipts. Make sure you have all the required documentation well in advance.

Selecting an Entry Method

Choose whether to file your taxes by mail or electronically. While traditional filing may take longer, e-filing is a speedier and more convenient choice.

Completing Your Tax Return

For assistance calculating your tax burden, use tax preparation software or speak with a tax expert. This is an essential step to prevent mistakes and future audits.

Looking for Expansions

You can ask for a six-month extension if you are unable to fulfill the Tax Day deadline. But keep in mind that the extension only pertains to filing your return—it has nothing to do with paying your taxes.

Making Tax Payments

Completing the Forms

Make sure you fill out your tax forms accurately and with all the information. To avoid errors, double-check your calculations.

Making Tax Payments

Make sure to include your payment with your return if you owe money on taxes. Checks and online payments are among the several payment methods that the IRS accepts.

Making Credit and Deduction Claims

Utilize the tax benefits and deductions that are available to you. These can raise your refund and drastically lower your tax obligation.

Following Tax Day: Monitoring Your Refund

You may check the status of your refund on the IRS website if you’re supposed one. The majority of refunds are processed 21 days after filing.

Resolving Concerns

To address any issues or inconsistencies with your return, get in touch with the IRS right once.

Conclusion

The end of tax season is April 17, 2023, which is Tax Day. This is a date that needs to be careflly planned and prepared for. Accurately calculating your taxes, assembling your paperwork, and selecting the best filing option can help you handle Tax Day with ease.