If you wanted to know what are GP fund rules in Pakistan then this post is for you. All government servants in permanent, temporary, or officiating service (including probationary service) irrespective of the class to which they belong, whose conditions of service the provident is competent to determine, are eligible to join the General Provident Fund.

GP Fund Stand for?

GP fund stands for General Provident Fund.

How much time is required for processing for a GP Fund case?

According to Finance Department Notification, on average, it takes 7 days to process a case of GP Fund advance and final payment GP Fund Case.

How much is processing time for GP Fund transfer case?

The processing time for the GP Fund transfer case is 5 days.

In case of death of civil Servant, who can be nominated for GP Fund?

The nomination can be made in favor of any person, but if a subscriber has a family (wife or wives, widow or widows, and children of deceased and husband in case of a female employer) he cannot nominate any person other than members of his/her family.

Can nomination be made in favor of more than one person?

Yes, the nomination can be made in favor of more than one person, with a clear indication of the share of each nominee in terms of the amount payable.

What is the rate of monthly subscription?

Subscription rates (subject to revision) from BPS-1 to 17 are as follows:

| BPS | GP Fund Subscription Rates |

| BPS-01 | 400 |

| BPS-02 | 710 |

| BPS-03 | 770 |

| BPS-04 | 830 |

| BPS-05 | 890 |

| BPS-06 | 950 |

| BPS-07 | 1010 |

| BPS-08 | 1070 |

| BPS-09 | 1140 |

| BPS-10 | 1210 |

| BPS-11 | 1290 |

| BPS-12 | 2220 |

| BPS-13 | 2400 |

| BPS-14 | 2620 |

| BPS-15 | 2890 |

| BPS-16 | 3340 |

| BPS-17 | 4270 |

| BPS-18 | 5360 |

| BPS-19 | 7180 |

| BPS-20 | 8050 |

| BPS-21 | 8940 |

| BPS-22 | 9880 |

Is GP Fund subscription is compulsory during EOL extra ordinary leave period?

Yes during EOL GP Fund subscriptions is mandatory.

Read More:- Gerneral Porvident Fund Rules

Is subscription mandatory during Foreign Service or on deputation?

Yes, subscription is mandatory during Foreign Service and on deputation.

What are the conditions for the sanction of a second refundable advance?

Sanction of a second refundable advance is subject to the following conditions:

- It must be sanctioned by the authority next above the sanctioning authority for first refundable advance.

- Such authority should mention the reasons for sanctioning the second advance.

Any outstanding balance of the first advance with interest will be recovered from the second advance so that only one advance is outstanding at a time.

How GP Fund is calculated?

GP fund is deducted on monthly basis from the salary of civil servants on fixed rates and then the yearly interest rate is applied to the GP fund balance.

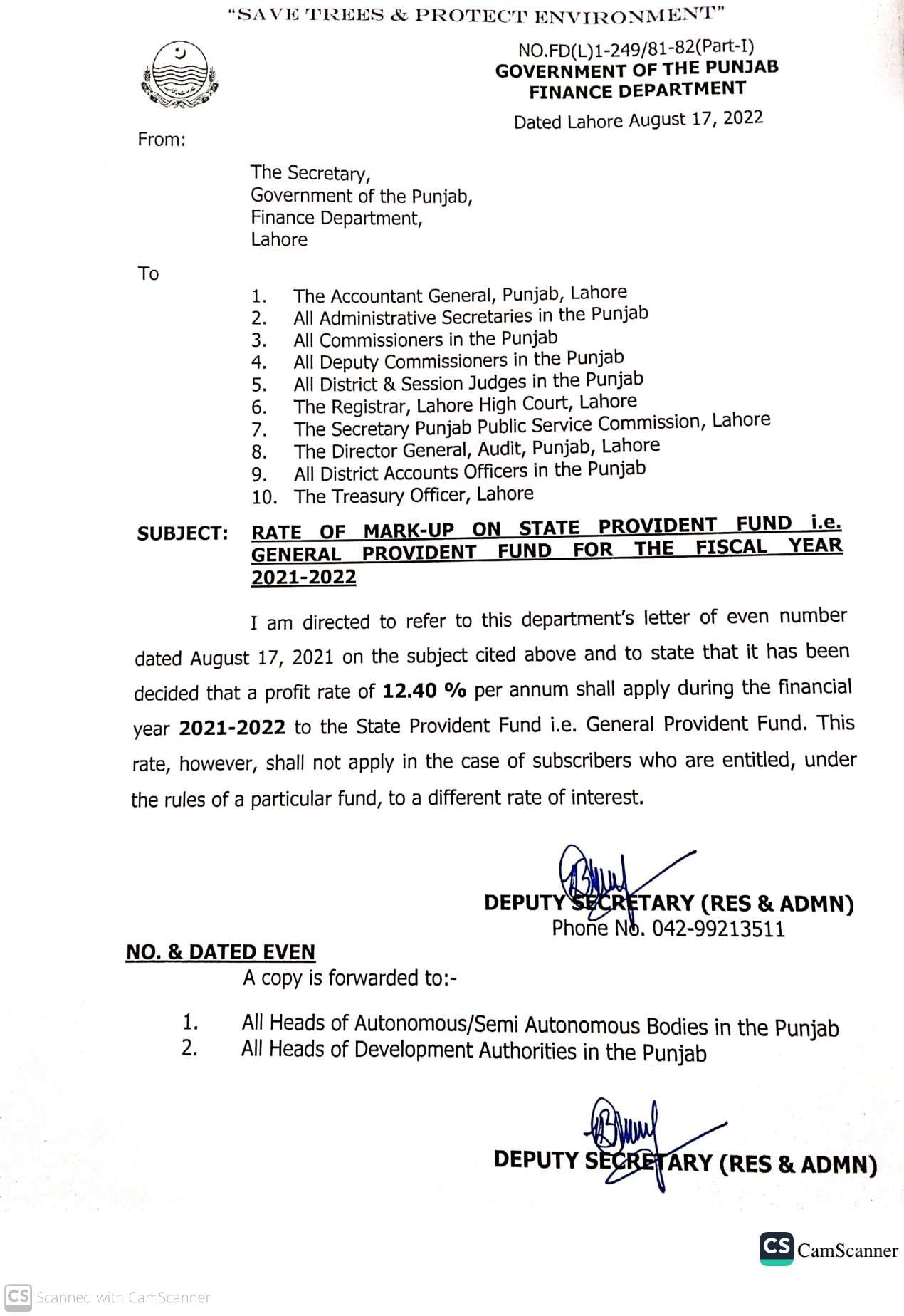

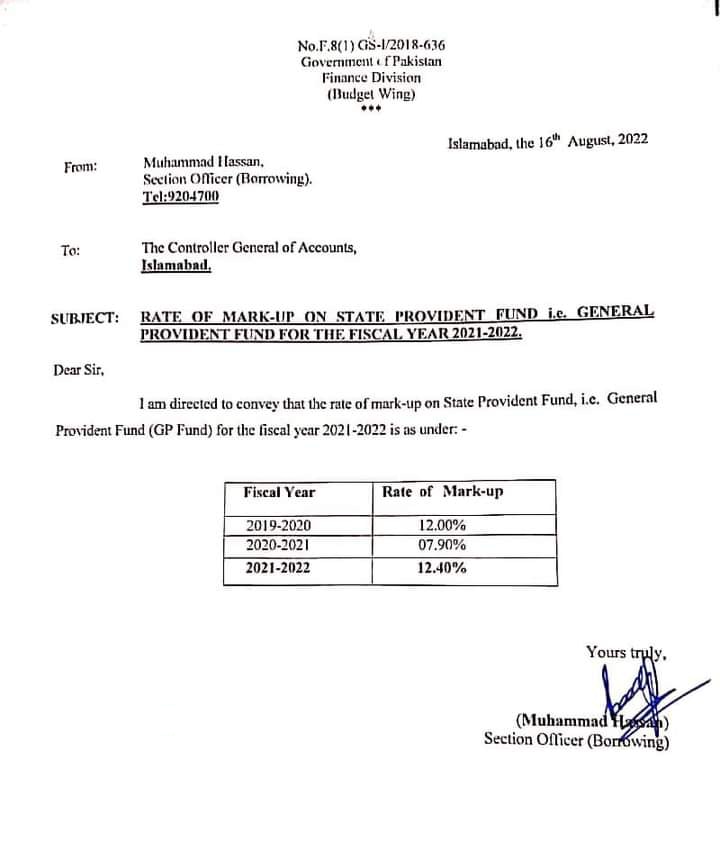

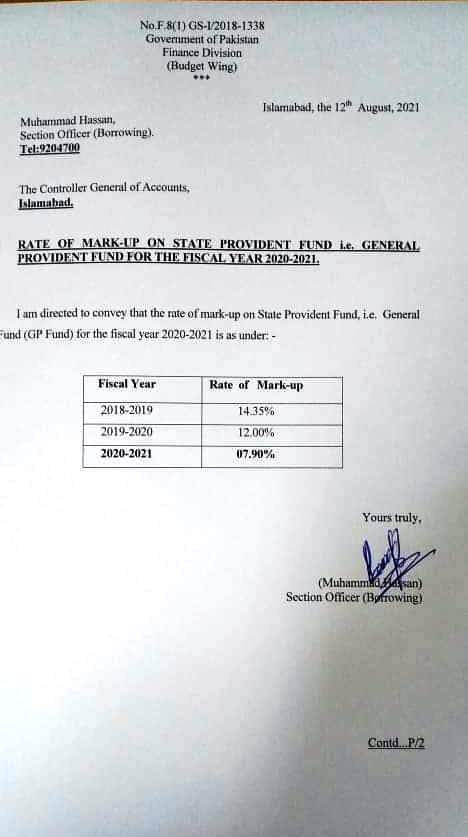

What is GP Fund interest rate 2020-21 in Pakistan?

According to the GP fund interest rate issued by Finance Department for the year 2020-21 is 7.9%.

How can I check my GP Fund Balance?

GP fund balance can be checked from monthly salary slips.

Is the GP fund is Taxable?

On the final payment, only Zakat @2.5% of the balance standing to the credit of the subscriber is deducted.

If a person avail EOL so the interest on GP fund is mandatory or not

Yes he will be given interest on his gp fund.