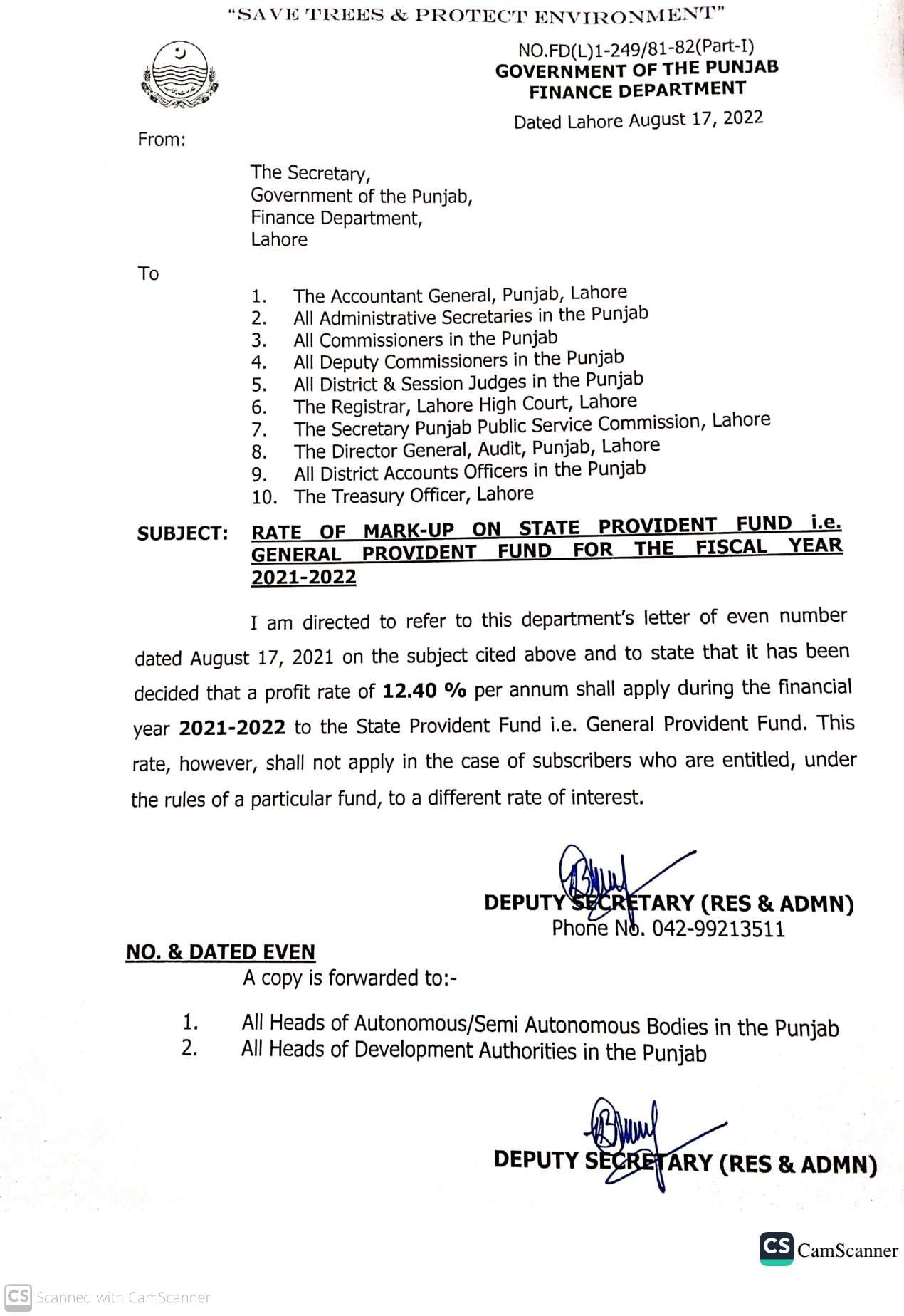

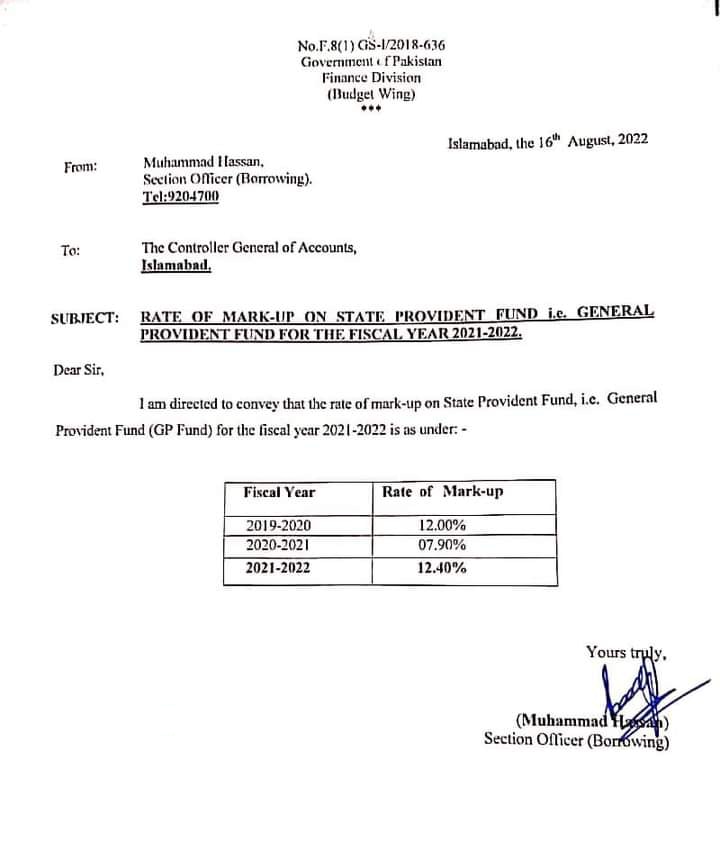

In this post, we will inform about general provident fund rules 1983 and in Province, Punjab General Provident rules 1978. All permanent employees of Pakistan can become general provident fund subscribers. The GP fund deducted monthly basis on fix rate defined by the Government of Pakistan. GP Fund subscriber will inform the respective account office about the nomination of one or more persons to collect the amount in case of death of Civil Servant during service. Subscriber may cancel his / her nomination at any time and will inform the cancellation of nomination to the respective account office. Furthermore, the government of Pakistan pays interest on the GPF balance each year. The interest rate paid from 9 to 15% each year. Zakat is also deducted and its rate is @ 2.5% is deducted while awarding GP fund payment according to rule 1980.

Types of GP Fund Advances

GP Fund subscribers can withdraw in advance from GP Fund. This advance may be temporary or permanent.

Temporary Advance

Firstly, we discuss temporary advances. This granted with the satisfaction of the competent authority. On the following grounds, a temporary advance granted.

- Medical illness of the employee or any person dependent on the civil servant.

- Purchase of Plot for construction of the house.

- It is also granted for the education purpose of children.

- If the servant wants to purchase a motor car, bicycle cycle, it may be the reason for sanctioning of GP fund advance.

Important Note:-Second advance awarded after a period of one year has passed since the drawl date of the previous advance. GPF advance recovery e will made at the percentage of 7% of civil servant basic pay.

Permanent GP Fund Advance

Incase, GP fund subscriber’s age is 50 years or beyond 50 years, he may draw non-refundable advance up to 100% on the GP fund balance. It is further added that subscribers allowed to draw a second advance at any time. It will be on non-refundable terms. Permanent advance granted on reasonable grounds satisfying competent authority.

GP Fund Final Payment

If a civil servant leaves the service on any grounds, the amount at his credit in GPF balance will pay to him. He may lodge an application to the competent authority before twelve months of retirement. During LPR GPF Subscriber can submit an application for withdrawal of GPF final payment.

Documents required for GP Fund Final Payment

Following documents required for GP fund final withdrawal.

- Last pay slip which shows lost general provident found detection

- Retirement order issued by the authority

- National identity card copy

- List of family members in case of death of Civil Servant

- List legal hairs in case of death of Civil Servant only

- Nomination in case of death only

- An account number along with branch code

- An account of legal Heirs in case of death only

- Zakat Declaration form

- Copy of service book

- A certificate stating that he has not withdrawal any GP fund advance during the service if drawn gives the details.

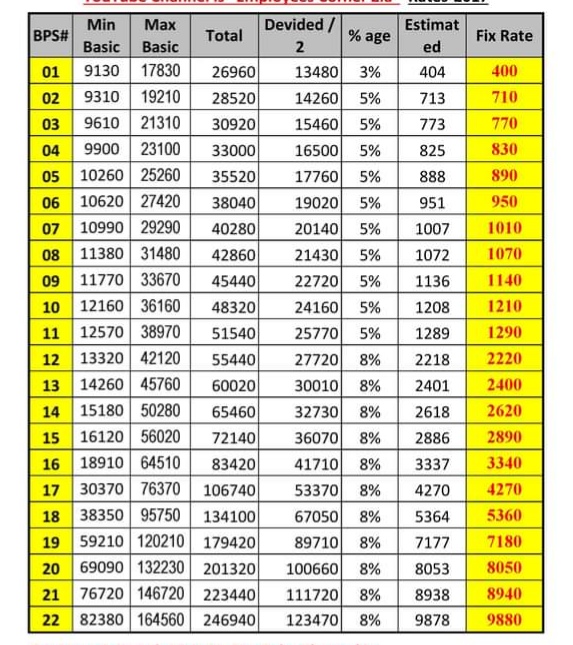

GP Fund Deduction Rates

We will discuss the latest GP fund deduction rates in Pakistan. These rates are applicable throughout the country. Special thanks to Mr. Zia BWN for this chart.