If you are a salaried person and want to learn how to calculate the income tax payable on your salary . Government of Pakistan has reduced the number of tax slabs for salaried persons. This announcement is made in Finance Bill 2022 in the budget 2022/2023 for fiscal year 2022-23. Pakistan Finance Minister Miftah Ismail announced the relief in tax for low salaries citizens.

When we see the Finance Bill, 2022 the government decided the reduction of salary tax slabs.According to the budget speech 2022-23, the persons whose monthly salary is Rs.100,000 (Rs.12,00000) will be exempted form income tax.

You can calculate it by using an online salary tax calculator. Infoghar Team is going to discuss the salary Tax Slabs for year 2022-23 with you. Our Team will share online salary tax calculator here. According to the income tax slabs for FY 2022-23 zero amount of income tax will be deducted from the salaries of individuals earning PKR 600,000/- per annum. And the servants whose earning is Rs.12,00000 will pay Rs.100 income tax.

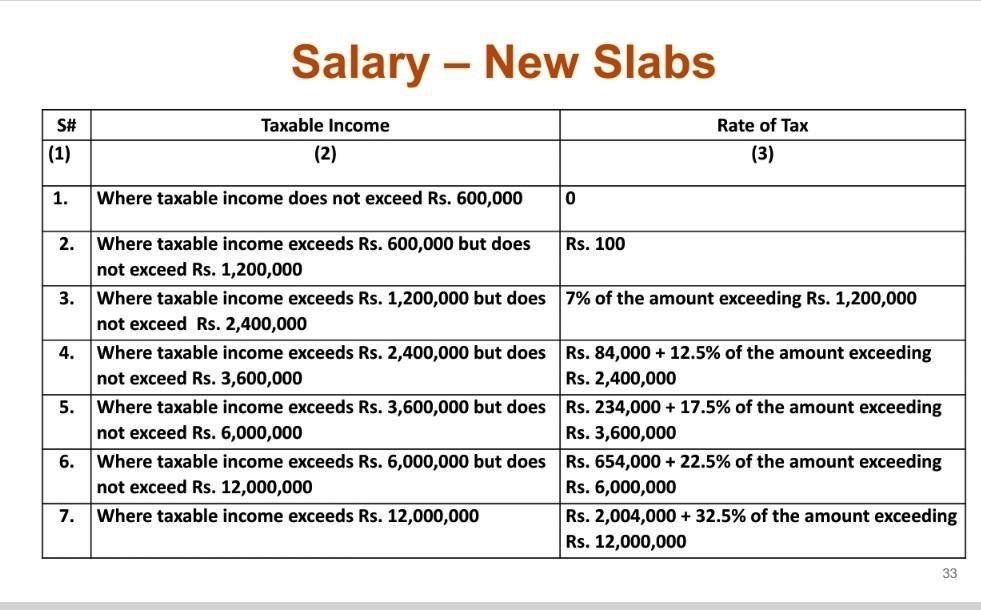

Salary Tax Slabs for year 2022-23

Whereas annual salary income exceeds Rs.100,000 per month Annually Rs.1.2 million. Then tax rate will be 7% of the amount goes beyond annual income of Rs. 1.2 million. According to income tax laws, it is not required to file income tax return for the exempted income and declare their assets.In the first budget of PML(N) 2022-23, the government has induced some changes to the income tax collection slab and excluded people whose earnings is upto Rs100,000 (per month).

In the budget speech for fiscal/ financial year 2022-23, the government has decided for exempting the salaries persons earning up to Rs.100,000 per month from paying income tax. Government has reduced income tax rate and income tax slabs for salaried person.

According to Income Tax Ordinance, 2001, the income tax is calculated on your total amount of gross salary.

| Serial# | Taxable Income | Taxable Income |

| 1 | taxable income does not exceed Rs. 600,000 | 0 |

| 2 | Where taxable income exceeds Rs. 600,000 but does not exceed Rs. 1,200,000 | Rs. 100 |

| 3 | Where taxable income exceeds Rs. 1,200,000 but does not exceed Rs. 2,400,000 | 7% of the amount exceeding Rs. 1,200,000 |

| 4 | Where taxable income exceeds Rs. 2,400,000 but does not exceed Rs. 3,600,000 | Rs. 84,000+ 12.5% of the amount exceeding Rs. 2,400,000 |

| 5 | Where taxable income exceeds Rs. 3,600,000 but does not exceed Rs. 6,000,000 | Rs. 234,000+ 17.5% of the amount exceeding Rs. 3,600,000 |

| 6 | Where taxable income exceeds Rs. 6,000,000 but does Rs. not exceed Rs. 12,000,000 | 654000 + 22.5% of the amount exceeding Rs. 6,000,000 |

| 7 | Where taxable income exceeds Rs. 12,000,000 | Rs. 2,004,000 + 32.5% of the amount exceeding Rs. 12,000,000 |

Income Tax Calculator 2022-23 Pakistan

How much income Tax will be deducted form your salary in the Budget 2022-23. You can find here by calculating online Income Tax Calculator.